This is a synopsis of workshop on stock markets in IITD.It is also follow up article on the previous discussion on workshop.

Ms. Renu Bhandari started with a note of How investment plays a vital role in managing our credits and therefore our lives.Ma'am highlighted that most of the people (as hightlighted in our previous discussions)do not have the required knowledge and know how of how to invest well in markets and therefore incur losses.She emphasised the fact that it was important to spend time before investing our money.

Also ,she highlighted the success of NSE in bringing a revolutionary change in the stock markets.Also, we got to know that trade has grown from 2 crores per day in 1990s to 2lakh crores per day today.This sudden change in 20 years has been due to three main reasons:

1.Technology

2.Good Practices(Transparency)

3.Liquidity

As desribed in the workshop there was an OPEN OUTCRY SYSTEM in earlier times under which there were brokers who met clients and placed orders.She explained that such a system was not at all transparent as brokers could take undue advantage of the less information which was there in the market with their customers.Also earlier there were 22-23 stock exchanges based on regional stock exchange.

Due to transparent practices of NSE,now low spread i.e. less difference between the price quoted by the buyer and seller is ensured.Also, it is now much easier to enter and exit out of the markets as compared to earlier times.

On,the basis of ranking,NEWYORK STOCK EXCHANGE and NASDAQ are at first and second positions respectively and NSE is at third.Ms.Bhandari said that NSE was third because it had less volume of trade but in terms of technology it is far ahead of them.Demat(dematerialised) settlement has been ensured by NSE.Moreover there are 1500+ brokers registered with NSE.

COST-BENEFIT ANALYSIS OF DIFFERENT INVESTMENTS (by Ms. Bhandhari):

First of all let us consider the safest investment.If we keep money in banks we will end up with 3-4% per annum.But if we invest in fixed deposits then we will end up getting 8-10% per annum.Now government also taxes on this income earned through interest rates.So from FDs we get 6-7% net income.But on the other hand, considering inflation scenario which is as high as 10.2 % we are at as our basket or purchasing power is becoming small.

MAIN STEPS BEFORE INVESTING:

1.Identify surplus funds:

First of all it is necessary for all investors to look at how much he needs to save and how much to invest from the savings obtained after all expenditures on health,parties or any other leisure or necessary activities.

2.Identifying products:

Identification of products mainly depends on our age and our risk appetite.Risk appetite is your capacity to take risk.Our risk appetite depends on our lifestyle and our income.identification of a product is a very important job as there are different products available in the markets.For e.g. equity markets which allow for higher risks with high return.Then there are purely safe fixed deposits and there are mutual funds with moderate risks.

3.Choosing Intermediary:

It is required of each customer to check whether their chosen intermediary is registered with exchange and SEBI or not.Also, it is important to complete all registration formalities.Moreover,ma'm also advised beware of intermediaries promising very high returns.

4.Track markets:

Lastly it is important for us to identify depending on time what and how much should we buy or sell.Moreover from the time we have bought stocks we should keep track of the markets and respond immediately according to our targets of stoploss and bookprofits.

Also,two types of markets primary markets and secondary markets were also discussed.

IPOs:

IPOs (Initial Public Offer ) is used by companies for collecting funds for expanding and diversifying their business.Price of an IPO is decided by two ways as highlighted in workshop.First, it could be a fixed price which was decided on by the company and other groups of traders and merchants.Secondly,its price could be decided by book bidding in which based on demand and supply company along with merchants decide the price.IPOs come under primary markets.

Also one question which was asked by Ms.Bhandari by a student was that,how can investors track their companies ,meaning thereby what are the indicators for investors?

In response she said,there were many methods by which we could check.For e.g. we could look at the liabilities and debts of the company and see whether they are increasing or decreasing.Also we can look at company's balance sheet and balance reports for tracking them.

MFs(Mutual Funds):

Investment in Mutual Funds consists of moderate return with moderate risk. In mutual funds we can have a good investment by investing for considerable period of time i.e. 3-5 years.Also,concept of SIPs was highlighted in the workshop.SIP which is systematic investment plan consists of investing monthly(like Rs. 5000 every month).So,because in mutual funds there are intelligent choices ,about buying and selling of stocks,made by investors in mutual fund companies therefore there less risk of incurring losses(moreover informed choices are themselves ensured and it is not necessary for people to track different companies).Investors in Mutual Funds ,from the money they raise ,they buy different stocks according to the analysis of different companies and thus book profit or losses.So,there is relatively lesser risk.

There are two options for suscribing mutual funds.First is buying mutual funds through agents .Second is filling up form with cheque in favour of AMC(Asset Management Company).Also if we want to redeem funds we could do so and we would get the payment based on the NAV at the end of day of mutual fund market i.e. 3 pm. MFs are also advantageous because we direct our investments directly from MFs to stock markets without redeeming our purchase and just by directly asking the mutual fund company to give our shares of stocks in the basket of stocks that we have purchased.

At the end ,ETFs (Exchange Traded Funds) were dicussed.These are an investment funds traded on stock exchanges much like stocks.These are most popular type of exchange traded products .Exchange traded products are derivatively priced security which trades intra-day on NSE.

Also Ms. bhandhari explained us what is meant by 1 ETF.1 ETF of gold means price of 1 gram of gold.In general 1ETF means 1/10th of the price of the stock.Also she told us about Nifty50 which includes best 50 stocks.Thus investing in NIFTY50 reduces the risk because if some stocks fall then some rise too.

Although, time was less, everything was clearly explained by ma'am.Altogether event provided us with greater insight to the markets and was an overall a good experience .

Friday, September 30, 2011

Thursday, September 29, 2011

National Stock Exchange Investor Awareness Lecture

Ms. Renu Bhandari, Manager, National Stock Exchange delivered a lecture here at IIT Delhi on Wednesday, 28 September. The lecture, presented in the V-Lecture Theatre-1, was attended by 100+ enthusiastic students, both from IIT and from nearby colleges. The lecture was basically an introduction to the stock exchange market, with Ms. Bhandari explaining the origins of the stock exchange and how NSE has grown in the post-reforms period---how a volume of Rs.2 Crore trade per day in 1994 has grown to Rs.2 lakh crore per day in 2011.

Ms. Bhandari discussed mutual funds and the emergence of the Gold ETFs---Exchange traded funds backed by gold. ETFs are based on real time movement of the underlying---gold or equities. The key difference between mutual fund and ETFs is that whereas mutual funds can be subscribed or redeemed only at the start or at the end of day-trade, ETFs can be traded in real-time.

NSE has made efforts to eliminate unauthorized intermediaries. Earlier large volume buyers were given preference and were given lower buying prices and higher selling prices than the ordinary buyer. With the elimination of unauthorized intermediaries, there are now equal prices for both the large and low volume buyers---effectively the democratization of the stock market. She explained that investors should deal only with intermediaries registered with SEBI. This is because in the case of complaints against the intermediary, NSE can only help the investor when the concerned Mutual Fund is registered with them.

She explained the main steps that an investor has to take before investing:

Ms. Bhandari also gave an introduction to the primary market comprising IPOs, and the secondary market comprising equities that are traded daily. Oversubscription of IPOs means that the IPO is booked more than the number of shares to be alloted. For instance if the IPO is oversubscribed 4 times, it means that for every 1 share there are four investors who have applied. In such a case each investor is allotted one-fourth the number of shares that they applied for. Whereas the price of an IPO depends on speculation, the long-term investment in that share depends on the business plan overall strategy of the company. She explained that short-term investments are speculations---they rely on profit/loss solely on by-the-minute news of the company, and not on the long-term plans and growth of a company.

She cautioned that even big name companies are not completely reliable to bring profits. Whether a stock performs well or not depends on many aspects, which include the kind of orders that it receives, the competition in the market that it has entered, and many other factors which depend not completely on the big name of the concerned company.

Ms. Bhandari discussed mutual funds and the emergence of the Gold ETFs---Exchange traded funds backed by gold. ETFs are based on real time movement of the underlying---gold or equities. The key difference between mutual fund and ETFs is that whereas mutual funds can be subscribed or redeemed only at the start or at the end of day-trade, ETFs can be traded in real-time.

NSE has made efforts to eliminate unauthorized intermediaries. Earlier large volume buyers were given preference and were given lower buying prices and higher selling prices than the ordinary buyer. With the elimination of unauthorized intermediaries, there are now equal prices for both the large and low volume buyers---effectively the democratization of the stock market. She explained that investors should deal only with intermediaries registered with SEBI. This is because in the case of complaints against the intermediary, NSE can only help the investor when the concerned Mutual Fund is registered with them.

She explained the main steps that an investor has to take before investing:

- Identifying surplus funds

- Identifying products

- Choosing intermediary

- Completing registration formalities

- Deciding on what, when and how much

- Monitoring the market movements

- Decision on Stop Loss or Book Profit

Ms. Bhandari also gave an introduction to the primary market comprising IPOs, and the secondary market comprising equities that are traded daily. Oversubscription of IPOs means that the IPO is booked more than the number of shares to be alloted. For instance if the IPO is oversubscribed 4 times, it means that for every 1 share there are four investors who have applied. In such a case each investor is allotted one-fourth the number of shares that they applied for. Whereas the price of an IPO depends on speculation, the long-term investment in that share depends on the business plan overall strategy of the company. She explained that short-term investments are speculations---they rely on profit/loss solely on by-the-minute news of the company, and not on the long-term plans and growth of a company.

She cautioned that even big name companies are not completely reliable to bring profits. Whether a stock performs well or not depends on many aspects, which include the kind of orders that it receives, the competition in the market that it has entered, and many other factors which depend not completely on the big name of the concerned company.

Saturday, September 10, 2011

Inflation and Interest Rates

This is a follow-up to the article Use of Interest Rates as an Economic Tool, and is a synopsis of an earlier discussion on the Economics Club Google Group.

Basically, to curb inflation, policy makers try to tighten the monetary policy so as to reduce purchasing capacity of the people. This results in reduced demand which therefore reduces price levels(downward shift in demand-price graph). For this they absorb a portion of the money supply, which they do by increasing interest rates. As explained in the previous article, increasing the interest rates would result in less spending and more saving, and therefore lesser money flowing in the economy.

However, the RBI is reluctant currently to increase interest rates. This is because of the large negative impact that has on businesses, and therefore on the GDP. Although one argument for interest rate hike is that real GDP is equal to nominal GDP(GDP measured in monetary terms in the year) divided by GDP deflator(equivalent to inflation), so that the nominal GDP rise is cancelled by the high inflation.

However if we look at the effect of rise in interest rate on the market, we see that interest rate hike reduces money flowing in the market, so that investment in projects will go down. Loans to entrepreneurs are also unfavorable which in the long term is negative for the economy For countries like India and China, which are focused on rapid economic expansion, an expansionary monetary policy with low interest rate is necessary, at the expense of high inflation. China for example has a high interest rate. This means that purchase levels have fallen, which means imports are costlier. But on the other hand a high interest regime actually encourages export, as exports bring money into the economy which can be invested with good returns. In the case of China, combining a high interest rate and rapidly increasing exports is possible because of the abundance of land and manpower. Also high interest rates attract foreign investment, which therefore creates a demand for the currency, so that the currency gains in value. But such a scenario is unstable because of the high foreign investment, which when withdrawn, could result in a considerable depreciation of currency. The risks can be seen in the example of the Latin American Debt Crises.

Basically, to curb inflation, policy makers try to tighten the monetary policy so as to reduce purchasing capacity of the people. This results in reduced demand which therefore reduces price levels(downward shift in demand-price graph). For this they absorb a portion of the money supply, which they do by increasing interest rates. As explained in the previous article, increasing the interest rates would result in less spending and more saving, and therefore lesser money flowing in the economy.

However, the RBI is reluctant currently to increase interest rates. This is because of the large negative impact that has on businesses, and therefore on the GDP. Although one argument for interest rate hike is that real GDP is equal to nominal GDP(GDP measured in monetary terms in the year) divided by GDP deflator(equivalent to inflation), so that the nominal GDP rise is cancelled by the high inflation.

However if we look at the effect of rise in interest rate on the market, we see that interest rate hike reduces money flowing in the market, so that investment in projects will go down. Loans to entrepreneurs are also unfavorable which in the long term is negative for the economy For countries like India and China, which are focused on rapid economic expansion, an expansionary monetary policy with low interest rate is necessary, at the expense of high inflation. China for example has a high interest rate. This means that purchase levels have fallen, which means imports are costlier. But on the other hand a high interest regime actually encourages export, as exports bring money into the economy which can be invested with good returns. In the case of China, combining a high interest rate and rapidly increasing exports is possible because of the abundance of land and manpower. Also high interest rates attract foreign investment, which therefore creates a demand for the currency, so that the currency gains in value. But such a scenario is unstable because of the high foreign investment, which when withdrawn, could result in a considerable depreciation of currency. The risks can be seen in the example of the Latin American Debt Crises.

Friday, September 9, 2011

Use of interest rates as an economic tool by Federal Reserve

Basically this description is based on an article shared on out google group on which I want to elaborate.

Federal reserve acts as a guardian of an economy.

Basically,effect of interest rate is shown on following :

1. Spending(which forms the base of the article)

2.Inflation/Recession

3.Stocks/Bond markets

Affects of interest rate on SPENDING:

- Federal Reserve uses interest rate as an important tool in determining the spending in the country.

- When the interest rate falls people tend to spend more because of two main reasons: Firstly,when consumers pay less interest they have larger amount of money at their disposal which creates a ripple effect in increasing spending.Secondly,alternative option of buying US-Tbonds(treasury bonds) is less attractive as it yields a low rate of interest. On the other hand,

- Higher rates of interest implies consumers have disposable income in their hands and thus they must cut back on their spending.

- Also alternative option of buying US-Tbonds seem to be more attractive as interest rates are high which also cuts spending more. Now that we have seen have seen how federal reserve manages spending,its more important to look why federal reserve would ever try to manage spending. INFLATION AND RECESSION:

- Interest rates to a large extent help in controlling the spending which in turn helps in controlling the situation of inflation or recession in an economy.

- When there is inflation federal reserve increases the interest rates which in turn cuts spending and thus due to less spending demand is less.Hence when demand curve shifts downwards in a prices vs. quantity of goods purchased curve it could be easily seen that the new equlibrium position (intersection of supply and demand curves) of resulting price will be less. (Price, quantity) decrease from (P2, Q2) to (P1,Q1).

- So in effect cutting down interest rates has helped in reducing inflation. On the other hand during recession:

- Federal reserve lowers the rate of interest due to which spending increases which in turn helps in increasing the demand .Therefore due to now more spending equilibrium level of price will be at a higher level and hence prices will increase. US bonds and stock markets:

- Investors always choose a higher rate of return.When interest rates rise then both businessman and consumers cut back on spending.This implies less amount now will be spent in the high-risk stock market, and and hence due to lowered demand, prices of stocks will gradually fall.On the other hand bond prices will fall and their yield will increase as the low demand drives a price fall.

- There are many other methods with the help of which the federal reserve can handle inflation or recession.

- For example it can affect the consumption by directly changing the government spending, because more government spending implies more supply, and therefore reduction in prices .

- Or it can also cut its spending and thus help during recession.

Gold:Bubble or Genuine Rise

This is a brief synopsis of a discussion on the Economics Club Google Group on a possible bubble building around gold.

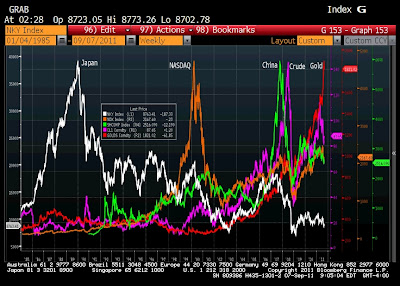

Gold has almost steadily risen from $256 an ounce in 2001 to $1,838 in September 2011, while there have been crashes in values of almost all other asset classes. This image conveys the message

Looking at this graph, what is our prediction. A continued increase in gold prices, or a sharp crash similar to what all the other asset classes have experienced. Lets consider the arguments against a gold crash:Gold has almost steadily risen from $256 an ounce in 2001 to $1,838 in September 2011, while there have been crashes in values of almost all other asset classes. This image conveys the message

1. Gold is scarce. No new mines are being discovered, and miners are digging as deep as 5km underground, while the concentration of gold in ore is declining. This scarcity means that the supply could not match the demand for gold, making sure that the rise in price is perpetual.

2. Wages of miners are increasing. Also increasing Environmental activism is forcing mine-owners to spend more on safety and environmental compliance. These factors get reflected in increase in gold price.

3. With India and China aiming at rapid economic expansion and global prominence as economic superpowers, they wish to move away from the dollar as a standard. Also with the recent US debt crises for the first time putting question mark on the stability of the dollar, people are increasingly going for gold.

4. The investor's preference to gold, over mutual funds, equities and hedge funds is returning. Exchange traded funds(ETFs) and pension funds are increasingly channeling their funds to gold.

5. Comparing to crashes in values of other asset classes, we take the example of the dot-com bubble burst. In this case, the excitement around the internet created a demand for internet services and infrastructure. However the demand was overestimated by the economy, so that the supply soon exceeded the demand. This finally lead to the crash. However such a thing is unlikely to happen for gold because excess demand cannot result in excess supply for gold, for the first and second reasons given above.

6. Finally a bit of history. A currency that has been the standard for 5,000 years is unlikely to change in its importance, given that nothing very drastic, like alchemical production of gold, has happened.

All these reasons above are why the general consensus is that the gold rise is not a bubble.So let us consider the arguments for the gold rise as a bubble:

1. Argument 5 against gold rise, that there is scarce supply to match demand, has also been applied to assets classes that have undergone crash in values. Take for example the housing market bubble in Japan in the 80's. The general belief was that, with Japan's rapid economic growth, demand for real estate would increase. However the available land was scarce and was not going to increase. With the economy booming, more and more money was pumped into real estate, and then the crash occurred, and the prices are now half of what they were during the boom. What this implies is that the "gold is scarce" argument is not completely rigorous, and may not prevent a crash in gold value.

2. The rise in gold prices may just be a reflection of the easy money that is pouring into gold. However once the money policy is tightened and interest rates increased, all this money can evaporate at the click of a key.

3. The very fact that gold is reliable could be its undoing. In the present highly fragile global scenario, a temporary dip in gold prices may cause panic in the markets, which might trigger a bigger crash in the stock market.

4. The optimism aroung gold as a non-crashable asset has turned it into a speculative instrument from a default and fail-safe asset class. The shift of gold from being an item of passive wealth to an instrument of speculation is dangerous, as it makes gold as a commodity similar to stocks, making it equally liable to market fluctuations, and therefore bubbles and crashes.

In the context of India, which has an estimated 18,000 tonnes of gold with individuals, a crash of gold could be the crash of the Indian economy.

Wednesday, September 7, 2011

Subscribe to:

Comments (Atom)