This is a brief synopsis of a discussion on the Economics Club Google Group on a possible bubble building around gold.

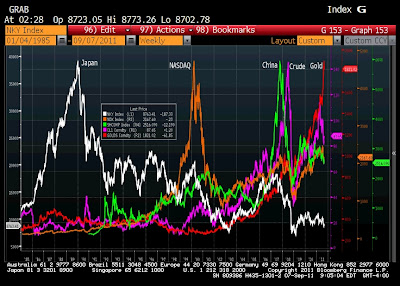

Gold has almost steadily risen from $256 an ounce in 2001 to $1,838 in September 2011, while there have been crashes in values of almost all other asset classes. This image conveys the message

Looking at this graph, what is our prediction. A continued increase in gold prices, or a sharp crash similar to what all the other asset classes have experienced. Lets consider the arguments against a gold crash:Gold has almost steadily risen from $256 an ounce in 2001 to $1,838 in September 2011, while there have been crashes in values of almost all other asset classes. This image conveys the message

1. Gold is scarce. No new mines are being discovered, and miners are digging as deep as 5km underground, while the concentration of gold in ore is declining. This scarcity means that the supply could not match the demand for gold, making sure that the rise in price is perpetual.

2. Wages of miners are increasing. Also increasing Environmental activism is forcing mine-owners to spend more on safety and environmental compliance. These factors get reflected in increase in gold price.

3. With India and China aiming at rapid economic expansion and global prominence as economic superpowers, they wish to move away from the dollar as a standard. Also with the recent US debt crises for the first time putting question mark on the stability of the dollar, people are increasingly going for gold.

4. The investor's preference to gold, over mutual funds, equities and hedge funds is returning. Exchange traded funds(ETFs) and pension funds are increasingly channeling their funds to gold.

5. Comparing to crashes in values of other asset classes, we take the example of the dot-com bubble burst. In this case, the excitement around the internet created a demand for internet services and infrastructure. However the demand was overestimated by the economy, so that the supply soon exceeded the demand. This finally lead to the crash. However such a thing is unlikely to happen for gold because excess demand cannot result in excess supply for gold, for the first and second reasons given above.

6. Finally a bit of history. A currency that has been the standard for 5,000 years is unlikely to change in its importance, given that nothing very drastic, like alchemical production of gold, has happened.

All these reasons above are why the general consensus is that the gold rise is not a bubble.So let us consider the arguments for the gold rise as a bubble:

1. Argument 5 against gold rise, that there is scarce supply to match demand, has also been applied to assets classes that have undergone crash in values. Take for example the housing market bubble in Japan in the 80's. The general belief was that, with Japan's rapid economic growth, demand for real estate would increase. However the available land was scarce and was not going to increase. With the economy booming, more and more money was pumped into real estate, and then the crash occurred, and the prices are now half of what they were during the boom. What this implies is that the "gold is scarce" argument is not completely rigorous, and may not prevent a crash in gold value.

2. The rise in gold prices may just be a reflection of the easy money that is pouring into gold. However once the money policy is tightened and interest rates increased, all this money can evaporate at the click of a key.

3. The very fact that gold is reliable could be its undoing. In the present highly fragile global scenario, a temporary dip in gold prices may cause panic in the markets, which might trigger a bigger crash in the stock market.

4. The optimism aroung gold as a non-crashable asset has turned it into a speculative instrument from a default and fail-safe asset class. The shift of gold from being an item of passive wealth to an instrument of speculation is dangerous, as it makes gold as a commodity similar to stocks, making it equally liable to market fluctuations, and therefore bubbles and crashes.

In the context of India, which has an estimated 18,000 tonnes of gold with individuals, a crash of gold could be the crash of the Indian economy.

No comments:

Post a Comment